.png)

RTP and Cross-Border Payments

RTP Cross-Border Networks are Poised to Grow

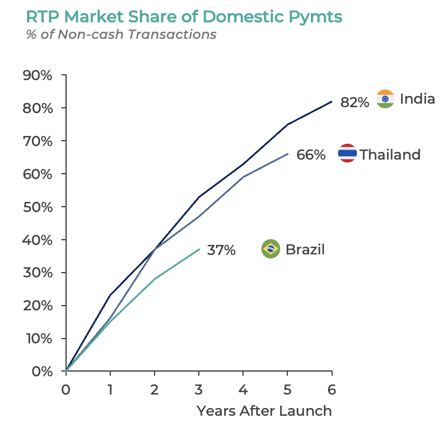

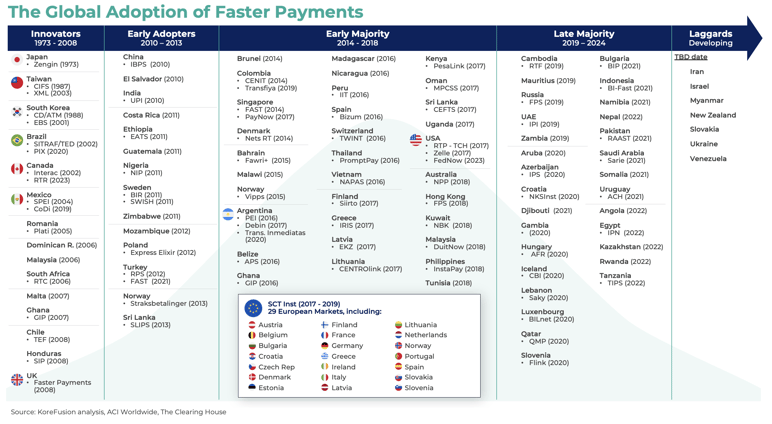

The adoption of immediate, faster, or real-time payments (RTP) has witnessed remarkable progress over the past two decades. As of 2023, more than 80 countries have either implemented or are in the process of deploying domestic RTP infrastructures. While the degree of adoption, platform architecture, and user experience may vary across different markets, countries such as India, Thailand, and Brazil have embraced RTP systems as the new standard for peer-to-peer (P2P) transactions and are gaining popularity in peer-to-merchant (P2M) payments as well.

The adoption of immediate, faster, or real-time payments (RTP) has witnessed remarkable progress over the past two decades. As of 2023, more than 80 countries have either implemented or are in the process of deploying domestic RTP infrastructures. While the degree of adoption, platform architecture, and user experience may vary across different markets, countries such as India, Thailand, and Brazil have embraced RTP systems as the new standard for peer-to-peer (P2P) transactions and are gaining popularity in peer-to-merchant (P2M) payments as well.

With RTP platforms maturing and introducing new functionalities, these payment solutions have become more user-friendly and have expanded to support a wide range of use-cases. They are now seamlessly integrated into a wide array of applications, ranging from banking apps and digital wallets to super-apps, online marketplaces, and payment automation platforms.

Crucially, RTP infrastructures have played a pivotal role in addressing the needs of previously unbanked or underbanked populations, facilitating transactions between bank accounts and digital wallets, and contributing to the gradual reduction in cash usage. Moreover, they have been catalysts for innovation, bringing transformative changes across the payments industry ecosystem and its value chain.

A New Frontier in Cross-Border Payments

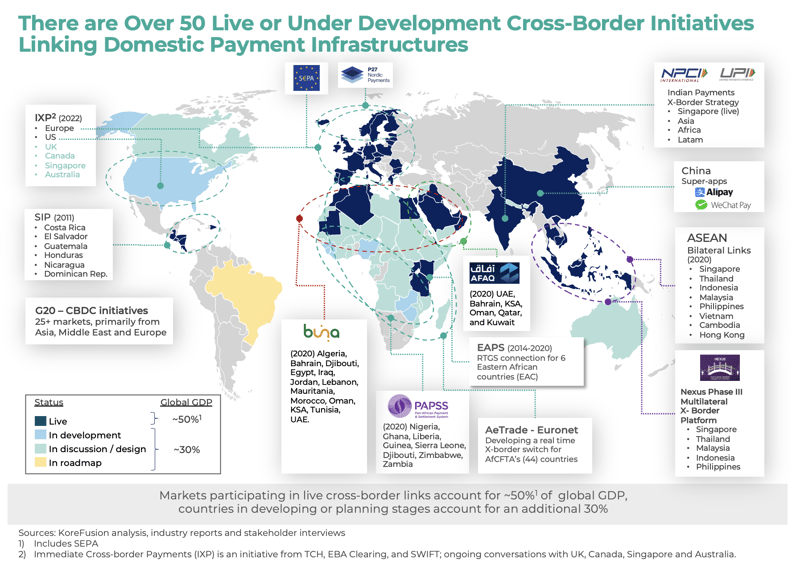

The global success of RTP systems has sparked a new trend: the emergence of over 50 initiatives aimed at establishing cross-border links between domestic RTP infrastructures. These initiatives leverage the existing user base and industry participants of domestic payment schemes to facilitate cross-border transactions while maintaining a familiar interface and user experience.

Examples of such initiatives include bilateral cross-border links in ASEAN markets, ongoing efforts to develop international acceptance for UPI by the National Payments Corporation of India (NPCI), multilateral platforms like Project Nexus by the BIS Innovation Hub in Singapore, and hub-and-spoke platforms such as Buna or AFAQ in the Middle East.

Since 2020, these initiatives have gained significant momentum, driven by the endorsement of the G20 and collaboration with international organizations such as the Bank for International Settlements (BIS), the Financial Stability Board (FSB), the World Bank Group (WBG), and the International Monetary Fund (IMF). With more than 100 countries actively involved in efforts to link their payment infrastructures, collectively representing around 80% of global GDP, cross-border payments have become a focal point for heads of state and regulators worldwide.

Key Cross-Border Initiatives

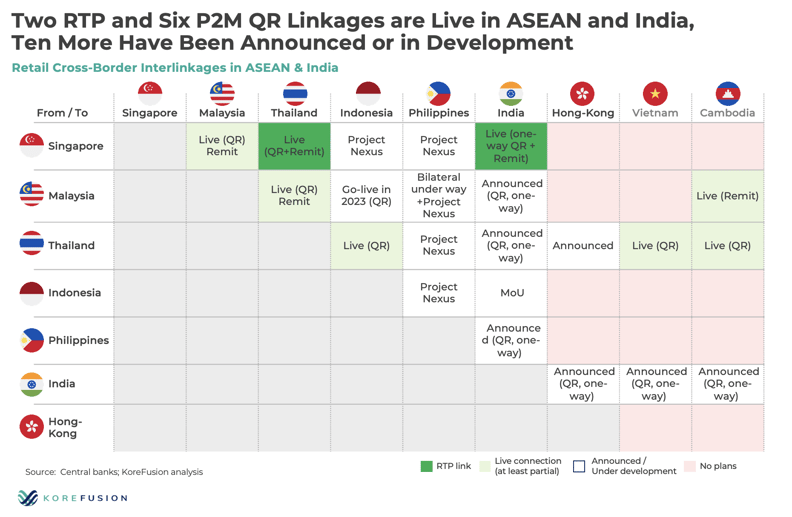

ASEAN Bilateral Links and Project Nexus

The ASEAN region leads in the development of cross-border RTP links, boasting 18 live, under development, or announced initiatives. The bi-lateral link between Singapore’s PayNow and Thailand’s PromptPay, launched in 2021, has been notably successful, capturing half of the corridor’s P2P volume. Notably, these platforms have developed interoperability between the QR standards and alias directories within their respective markets.

Given the significant presence of immigrants and travelers in the region, the primary focus of these bilateral links is to facilitate faster and more affordable P2P remittances and person-to-merchant (P2M) payments for international visitors. These use-cases are setting the foundation for a likely expansion into an array of use-cases, such as P2M for e-commerce and lower value B2B and B2C payments.

Driving the development of these cross-border linkages are ASEAN central banks and regulators, motivated by four pivotal objectives that include gaining control over critical infrastructure, enhancing payment efficiency and transparency, strengthening monetary sovereignty, and aligning with the G20 objectives to support digitization and financial inclusion.

The early adopting markets have fostered extensive collaboration across the region, sharing technical insights, operational best practices, and lessons on standardizing scheme rules and compliance requirements. This collaborative effort has catalyzed the development of new bilateral links across the region. However, while ASEAN regulators remain keen on expanding the number of links, it's evident that the bilateral model doesn’t scale-up efficiently. Such links require substantial investments from each participant for every new connection, rendering them only viable for high-volume corridors.

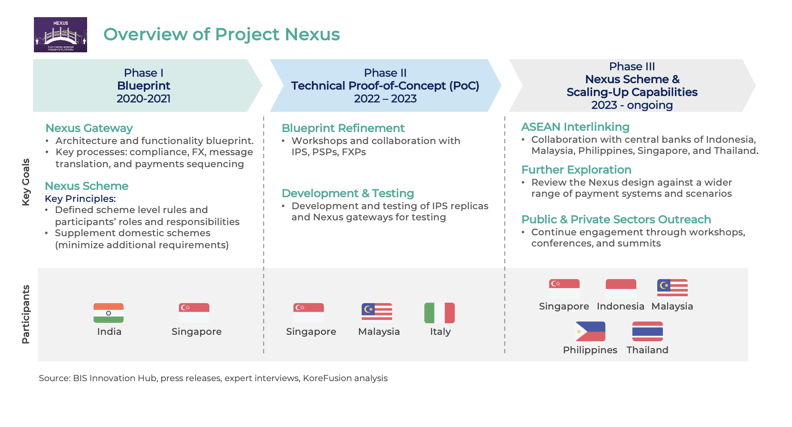

In response to this challenge, the Bank for International Settlements (BIS) and five ASEAN markets are collaboratively working on developing a multilateral platform, known as Project Nexus. Besides working on a suitable technical solution, significant challenges remain, including establishing the governance framework for a regional platform and harmonizing scheme rules and compliance requirements.

Middle East and North Africa (MENA) and the GCC

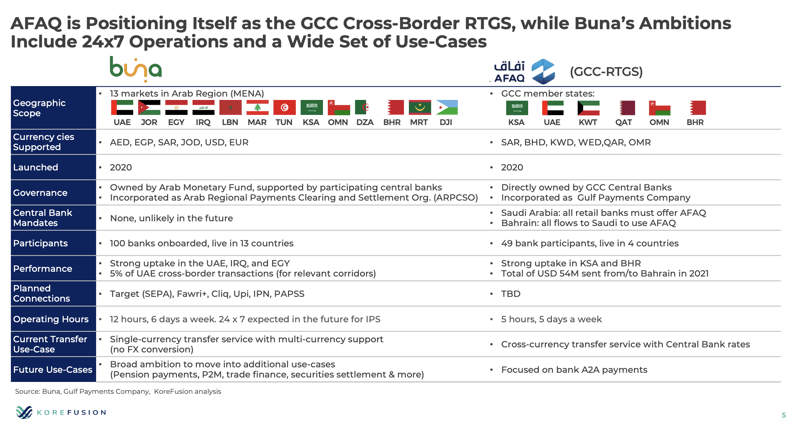

There are two cross-border initiatives under development in the region: the Arab Regional Payment System (Buna) by the Arab Monetary Fund, which has over 100 participants from 14 markets in MENA; and AFAQ by the Gulf Payments Company, led by the central bank of Saudi Arabia, has onboarded over 50 participants from GCC markets.

Given the nascent nature of RTP systems in the region, both initiatives are currently focused on developing a faster and more efficient clearing and settlement infrastructure for wholesale payments, by linking the region’s RTGS systems. However, Buna does have the ambition to target a large set of use-cases, including P2M payments, and to develop links with markets beyond MENA. In contrast, AFAQ has not expressed any plans to go beyond wholesale payments within the GCC.

India's NPCI International Strategy

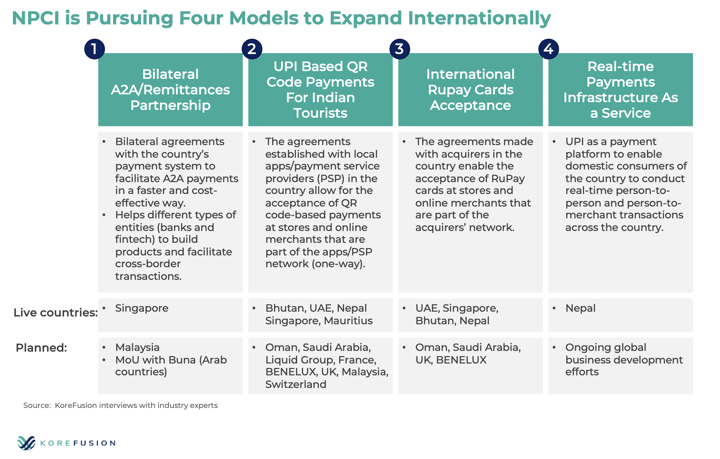

The National Payments Corporation of India (NPCI) has outlined an ambitious international strategy, concentrating on enhancing the interoperability of the Unified Payments Interface (UPI) with QR payment platforms across various markets, alongside expanding the global acceptance of the RuPay card. The primary objectives of the NPCI are to facilitate easier payment solutions for Indians traveling or residing abroad and to make the remittance process more efficient for non-resident Indians.

To this end, UPI has successfully established interoperability with QR-based payment systems in Singapore, the UAE, and Bhutan. The initiative is progressing through different stages of development in four markets within the Middle East and Asia. Moreover, through collaborations with partners such as Buna, Liquid Group, Worldline, Lyra, Payxpert, and Terrapay, NPCI is aiming to extend UPI's acceptance to at least 30 additional markets.

US and Europe

The Clearing House (TCH), EBA CLEARING, and SWIFT are collaborating on the Immediate Cross-Border Payments (IXB) pilot service, aimed at facilitating cross-border payments in USD and EUR. Drawing upon a similar framework to Project Nexus, the IXB initiative seeks to establish a connection between the Real-Time Payment (RTP) system in the United States, operated by TCH, and the RT1 system in Europe, managed by EBA CLEARING. Additionally, discussions are ongoing with other countries about potentially joining this initiative.

This effort is in line with the G20's goals for creating payment systems that are fast, cost-effective, transparent, and widely accessible. The technical proof of concept has been completed, and efforts to align with regulatory requirements are progressing, setting the stage for a commercial launch slated for 2024.

Africa

The Pan-African Payment and Settlement System (PAPSS) represents a pivotal development in Africa's financial landscape, offering a real-time gross settlement (RTGS) infrastructure designed for cross-border payments. Officially unveiled in January 2022 by the African Union (AU) and the African Export-Import Bank (Afreximbank), PAPSS aims to support trade under the African Continental Free Trade Area (AfCFTA). This launch followed a successful commercial debut in the West African Monetary Zone, which includes Gambia, Ghana, Guinea, Liberia, Nigeria, and Sierra Leone.

In addition, EuroNet and the Africa Electronic Trade Group (AeTrade) announced the launch of a cross-border switch in November 2022. This platform is designed to connect 44 African countries along with their central banks, financial institutions, and mobile wallets, marking a major step towards financial integration across the continent.

Latin America

Latin America's path to cross-border payment integration has been marked by both challenges and achievements. Initiatives like the Sistema de Interconexión de Pagos (SIP) in Central America and the Direct to Mexico have shown promise but have struggled to fully take off, partly due to concerns from financial institutions about losing revenue from SWIFT correspondent banking cross-border services.

In contrast, Brazil's Pix system has seen remarkable success since its introduction in 2020, and has had plans for cross-border payments from the outset. Although specific details are still forthcoming, the development of payment links with some of Brazil's key trading partners—including China, the United States, Argentina, Chile, and European countries—appears to be on the horizon. It's worth noting that numerous fintechs and cross-border networks are already leveraging Pix for the first and last miles of cross-border transactions.

A New Transformative Era For Cross Border Payments

In summary, a growing number of initiatives such as the ASEAN's bilateral links, India's NPCI international strategy, the Middle East's Buna and AFAQ, and collaborative efforts like Project Nexus and the IXB pilot in the US and Europe, are pioneering the integration of domestic RTP infrastructures on a regional and global scale. These efforts are driven by a common goal to enhance payment efficiency, transparency, and accessibility, aligning with the G20's objectives for digitization and financial inclusion.

Despite challenges such as technical interoperability, scalability and regulatory harmonization, the commitment of over 100 countries, representing around 80% of global GDP, underscores the significant momentum towards realizing a more interconnected and efficient global payment landscape.

This article marks the beginning of a series examining the ongoing global developments in cross-border links between domestic payment infrastructures. In upcoming deliveries, we will delve into the drivers of this new trend, its challenges, the broader implications for traditional and emerging players in the payments industry and will offer our vision into how these platforms may evolve going forward.

If you would like to discuss the implications of these developments to your business, and how KoreFusion may help you be better prepared, please reach out to: information@korefusion.com.

About KoreFusion

KoreFusion provides strategy consulting and M&A advisory services exclusively for the international fintech, payments, and financial services industries.

![]()

Author:

Javier Guerrero

Share: