Payments are

Everywhere

Payments are everywhere; we build payments strategies for all industries.

Payments are

Everywhere

We are KoreFusion: we provide insights and advice across international payments and financial services.

Years of

Experience

Projects Completed

in the Last Ten Years

Countries and

Counting

Returning

Clients

Members of

We provide valuable advice and hard-learned insights to companies that are transforming the world of payments and financial services.

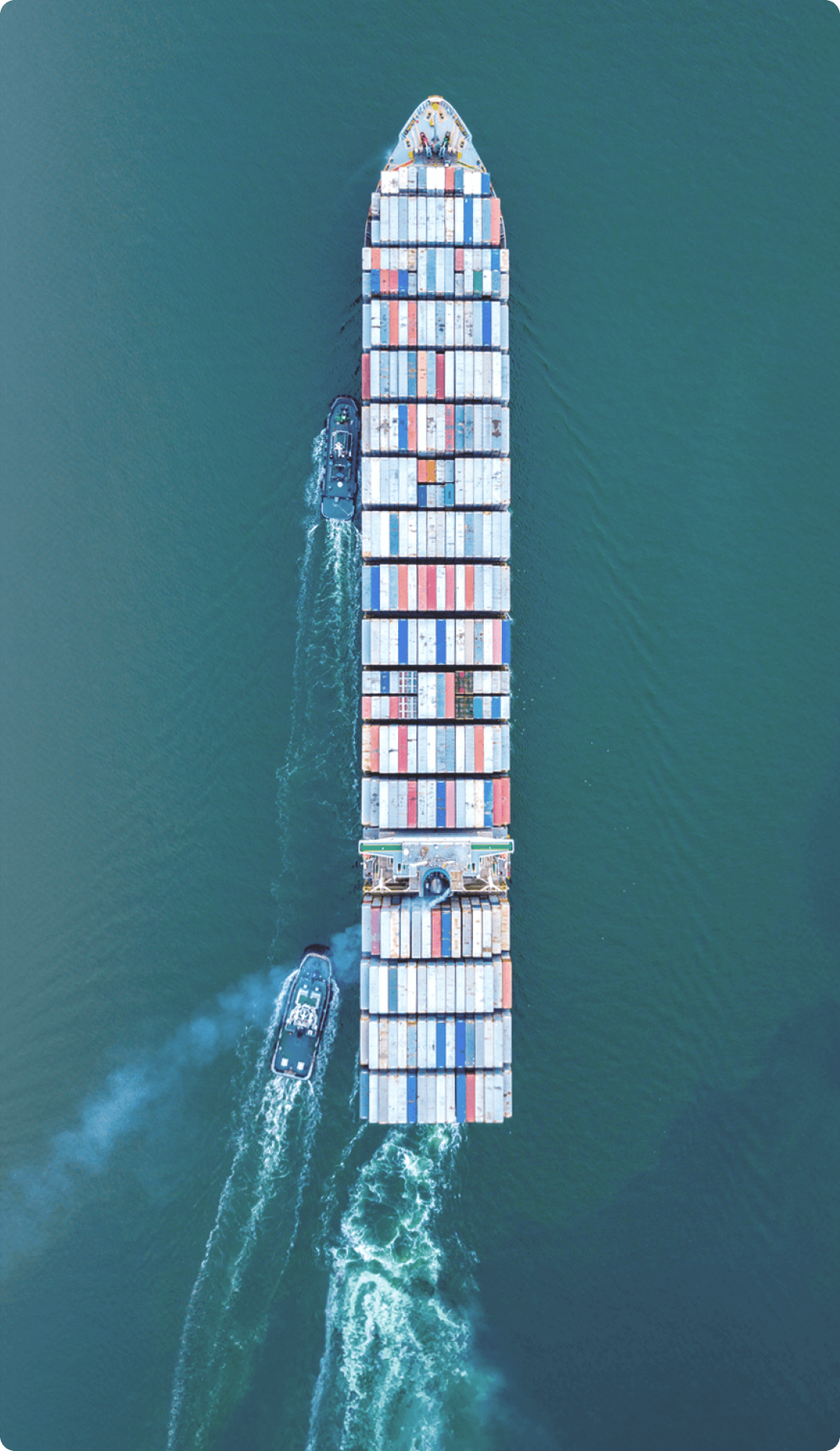

Payments are

Everywhere: Freight

Our Consultancy and Investment Banking services are exclusively related to payments and fintech.

Our leadership team has 28 years shaping payments strategy for both established leaders and challengers.

We take pride in the depth, intelligence, and vision of our work.

We are proud that 90% of our projects come from returning clients.

We embrace diversity and offer inclusion and flexibility.

We have on-the-ground experience and professional networks across 79 developed, emerging, and frontier countries.